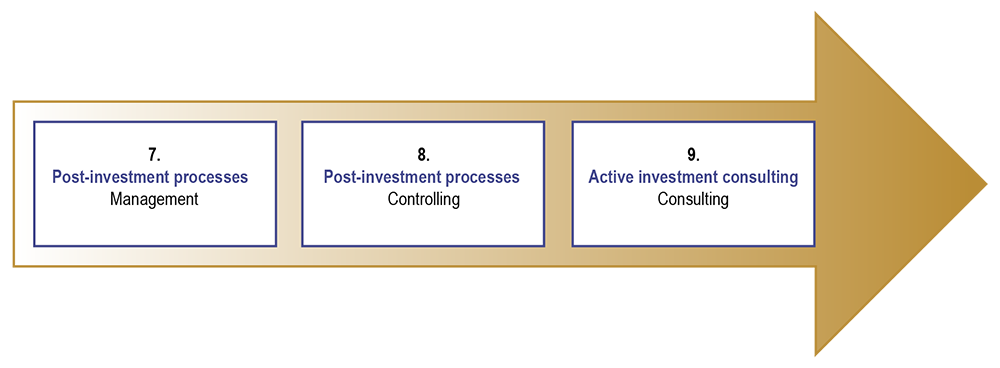

The investment process of VENTUSOLAR Global Capital

Together with highly qualified and established partners VENTUSOLAR Global Capital provides institutional investors of any size with access to Renewable Energies. This is within the framework of conventional, proven European financial structures. The investment process is based on solid and international standardized rules - consisting of Asset Sourcing, Due Diligence as well as Post Investment Management und Controlling.

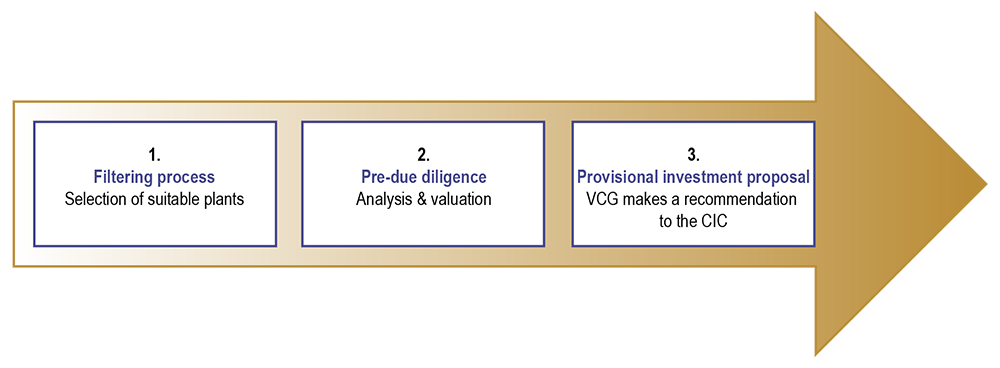

Asset sourcing – selection and analysis

(1) Filtering process – Selection of suitable plants

VENTUSOLAR Global Capital GmbH (VGC) filters, analyzes and evaluates projects that have been approved and are under construction as well as existing plants in their global network that exactly meet investment criteria.

(2) Pre-due diligence – Analysis & valuation

Plants and projects accepted by the VGC Investment Committee then undergo a thorough internal pre-due diligence.

(3) Provisional investment proposal – VCG as an investment advisor makes a recommendation to the capital investment company (CIC)

If the pre-DD is positive, the management of VGC, in its role as the investment advisor, will give an investment recommendation to the CIC (preliminary investment proposal “PIP”).

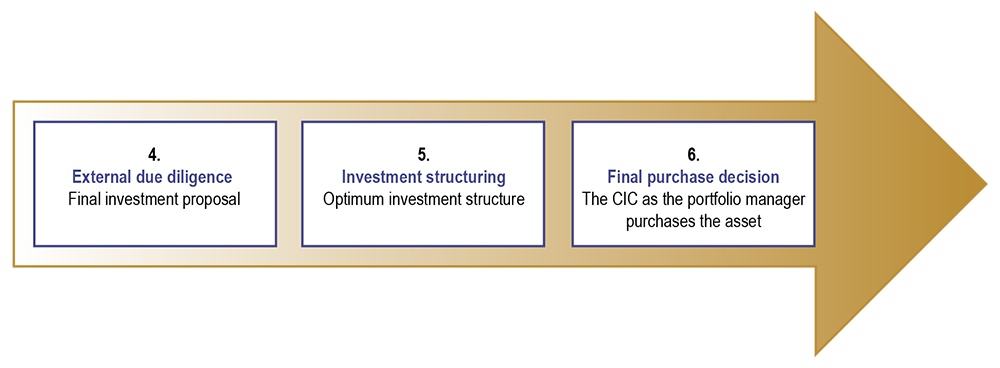

Due diligence – final purchase decision

(4) External due diligence – Final investment proposal

For further consideration an external due diligence partner is consulted who issues a final investment proposal (FIP); parts of the due diligence are awarded to local external experts (finance, law/tax, technology, environment).

(5) Investment structuring – Optimum investment structure

The external due diligence partner and local tax and legal experts provide advice on the optimum investment structure. The purchase and operating agreements are drawn up by external attorneys, at the location if appropriate.

(6) Final purchase decision – The CIC as the portfolio manager purchases the asset

The CIC, as the portfolio manager responsible, takes the final decision based on the FIP on the purchase of the assets in the predefined investment structure.

Post-investment management & controlling

(7) Post-investment processes I – Management

Together with an external independent qualified asset manager, VGC monitors the assets, O&Ms and the management of the asset cash flows.

(8) Post-investment processes II – Controlling

Operating data are evaluated. Reporting at the level of VGC with the CIC Continuous control of the financial models and valuation of the purchased assets by the CIC and the auditor.

(9) Active investment consulting – Consulting

VGC processes all the controlling results and suggests recommendations for action.